Banks and startups are racing ahead with smarter platforms, deeper integration, and stronger identity and security solutions. The era of simple online banking is over. This year brings agentic AI-driven products, embedded finance everywhere, tokenisation of assets, instant payments, and robust digital identity and security at the core.

What’s changing – at a glance

Here’s what’s shifting fast:

- AI taking charge: From chatbots to autonomous agents, financial products are beginning to make decisions. Firms are embedding intelligence into credit, fraud detection, and customer interactions.

- Embedded finance grows: Banking features now show up in non-financial apps. Payment links, lending, and investing are becoming invisible parts of everyday services.

- Instant payments & rails: Money moves in real time. Tokenised assets and digital currencies add new layers of speed and choice.

- Tokenisation and digital identity: Assets are becoming tokens. Identity verification is stronger and built-in. Fraud and risk get new defences.

Platform plays: banks versus startups

Traditional banks once led the scene. Now both big banks and nimble fintech startups are chasing platform models. Embedded banking, open banking rails, and fintech ecosystems are everywhere. Platforms allow non-banks to offer financial services and let banks plug into broader ecosystems.

Startups often move fast. They build the tech and attract digital-first customers. Banks meanwhile are leveraging brand trust and regulatory experience to upgrade legacy systems. The winners will be those who blend tech agility with regulatory security.

Key trend: agentic AI

Agentic AI is more than a tool—it is a decision-maker. These systems act autonomously, execute tasks, and learn from data. Financial firms are applying this across operations: lending, fraud, and customer service. The challenge: governance, bias, and explainability.

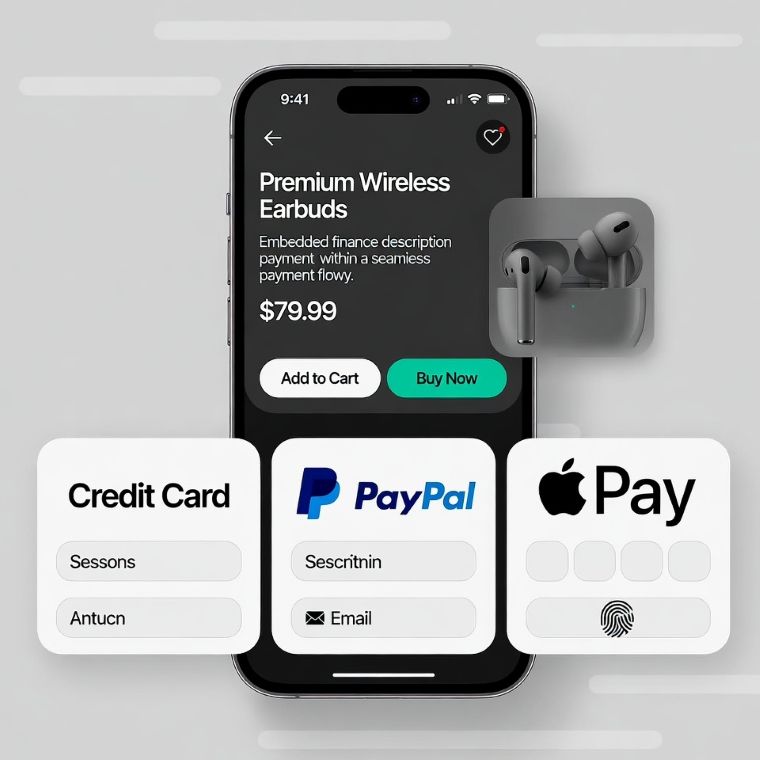

Key trend: embedded finance

When financing, payments, borrowing, and investing move into apps you already use—shopping, games, social media—you get embedded finance. It is seamless and that changes user expectations. Many fintech firms now view themselves as infrastructure players.

Key trend: instant payments & tokenisation

Speed matters. Instant payments mean money moves with zero lag. Tokenisation allows assets, real-world or digital, to be broken up, transferred, and managed more flexibly. This is unlocking new business models.

Security, identity & trust

As capabilities expand, risk mounts. Digital identity systems must be stronger. Fraud is smarter. Cyber threats evolve. Firms are investing heavily in identity verification, behavioural biometrics, and AI-driven security.

Why this matters to users

- You will see financial services appear in places you did not expect—apps, platforms, and websites you already use.

- Money moves faster. Waiting for days is becoming a relic.

- Ownership gets fluid. Assets once locked to institutions can be tokenised and traded in smaller parts.

- Your identity and data matter more. How companies protect you will impact your choice of provider.

What to watch for

- Will banks reinvent themselves as tech + finance platforms, or will startups dominate?

- How will regulation keep up? Embedded finance and tokenisation span borders and jurisdictions.

- Can AI products scale ethically and securely? Autonomous decision-making brings new risks.

- Which assets go live as tokens, and who controls the rails?

Closing thoughts

Fintech in 2025 is about execution, not just ideas. Firms that build agentic AI-driven products, embed finance deeply, enable instant payments, use tokenisation wisely, and invest in identity and security are setting the pace. Users should expect more seamless, more responsive, and more secure services. The financial world is shifting under our feet.